No time for Research? 3 High-speed Research Methods for Growth 🔎

🎁 Bonus — Free Survey Templates for Onboarding, Power Users, Upgrade & Pricing research.

Hello everyone 👋 I’m Kate Syuma, and welcome to Growthmates.news — the newsletter where we explore inspiring and practical growth stories from products we love. Join the community of 5,500+ Product, Design, and Growth people from companies like Amplitude, Intercom, Miro, Atlassian, Grammarly, Framer, and more.

What is good for the user is good for business. This phrase became my professional motto and has remained so for years. However, let’s be honest with ourselves and check in for a second:

When was the last time you talked to your end user?

How often do you usually talk to them?

What holds you back from that?

In the reality of high-paced work on product growth, I’ve seen many times teams sacrifice research activities because it takes too much time.

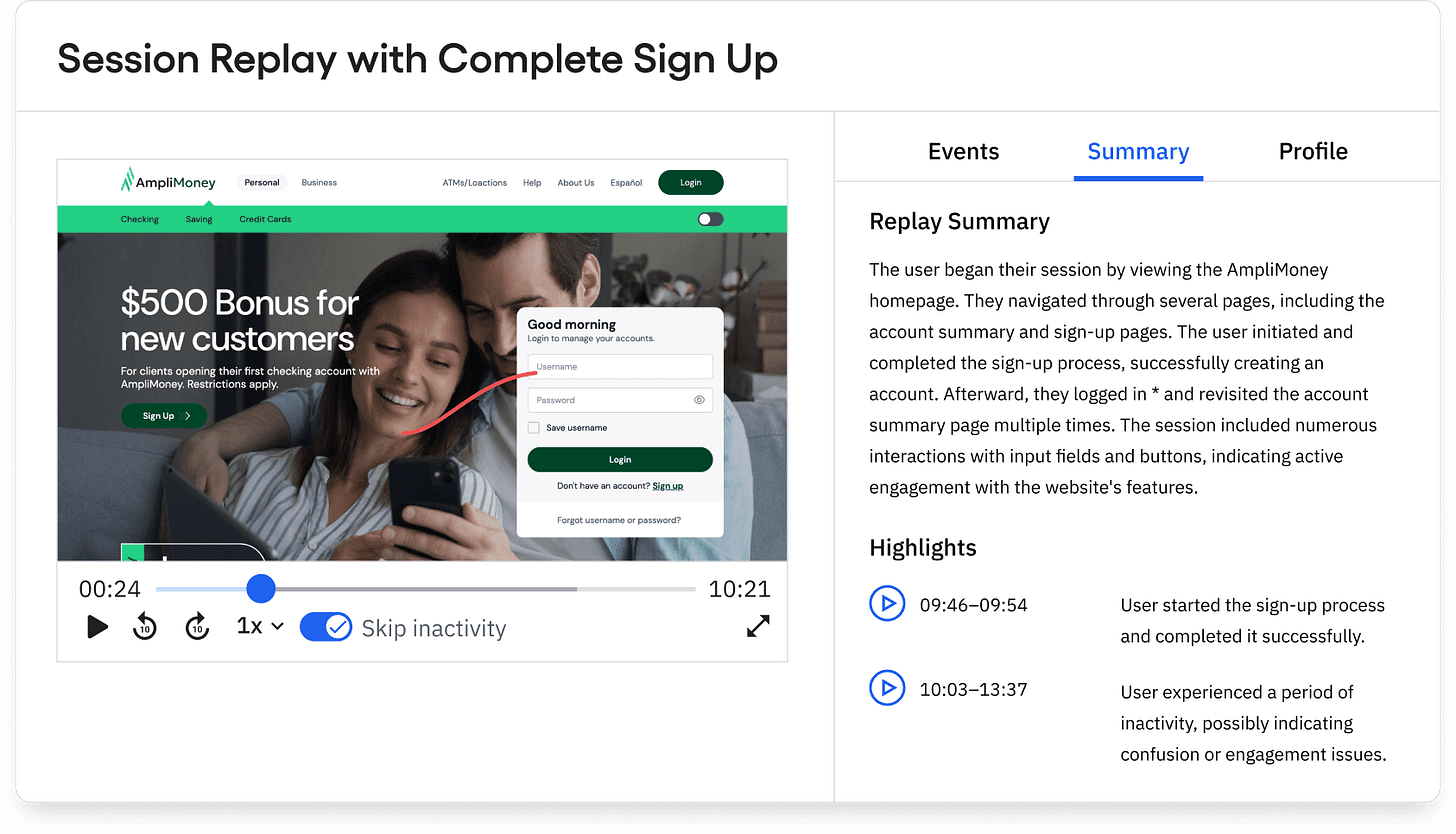

Before we dive in…This post is brought to you by Amplitude — the product analytics platform that helps teams understand user behavior and build better experiences. With Session Replay, you can watch real user interactions to uncover friction and get real-time qualitative insights!

Today, we’ll see how we can get closer to users in a high-speed environment 👇

Account Research (before User Research) to iterate on messaging and positioning;

User Survey Templates to uncover growth insights for the entire funnel;

How to get real-time insights to learn about user behavior constantly.

1. Account Research (before User Research).

For B2B products, building a deep understanding of your ICP (Ideal Customer Profile) is essential. Before diving into end-user behavior, start with account-level insights — the context of the company, their challenges, and what signals they’re giving off.

Typically, the B2B ICP description includes many elements, such as:

Market & Industry — What specific vertical/sector do they operate in?

Geography —In which countries/regions do they operate?

Size — What is their growth stage? (Easy-stage, SMB, Enterprise)

Problems — What are their top 3 business challenges?

Implications —What revenue is lost due to these problems?

User Role — What is their job title and department?

Buyer Role — Who are the key decision makers?

Buying Process — What is their average purchase timeline?

Technographics —What core systems do they use?

The more detailed your profile, the sharper your positioning and messaging — both externally (marketing, sales) and internally (onboarding, in-product UX).

💬 You might ask, “Kate, we have 100s of potential companies. How do we prioritize with limited time?”

💡 My answer: you don’t need 100s — you need the right 10 to 20 accounts. And you don’t need hours of manual research anymore.

But how do you narrow it down and get insights before jumping on a call? Luckily, we live in the world of AI, and we have various tools that can do this job for us.

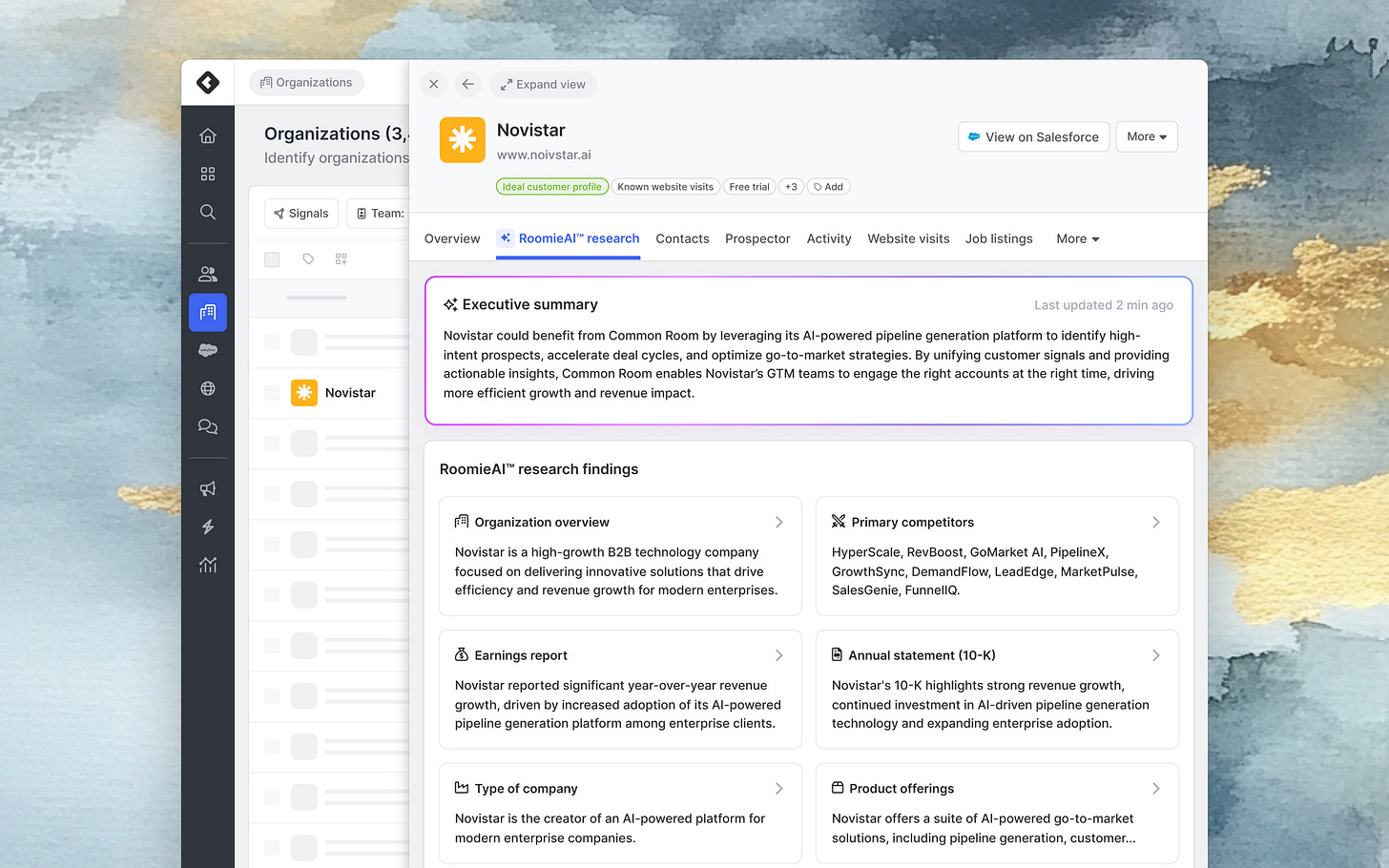

Recently, I uncovered the feature from CommonRoom that helps you go from guesswork to signal-based prioritization in seconds. Their new AI-powered account research helps you cut the time from 60 minutes to 60 seconds by surfacing:

Recent funding or hiring signals;

Product usage and engagement trends;

Competitor mentions;

Community signals from Slack, Discord, social, and forums;

Website and content interaction patterns;

…and the list goes on.

After collecting these insights, you can use summaries to prioritize accounts with these insights. With this data, you can cluster accounts based on readiness, fit, or intent — and personalize your approach even before the first conversation. It’s a high-speed way to get closer to the right accounts first, not just more of them.

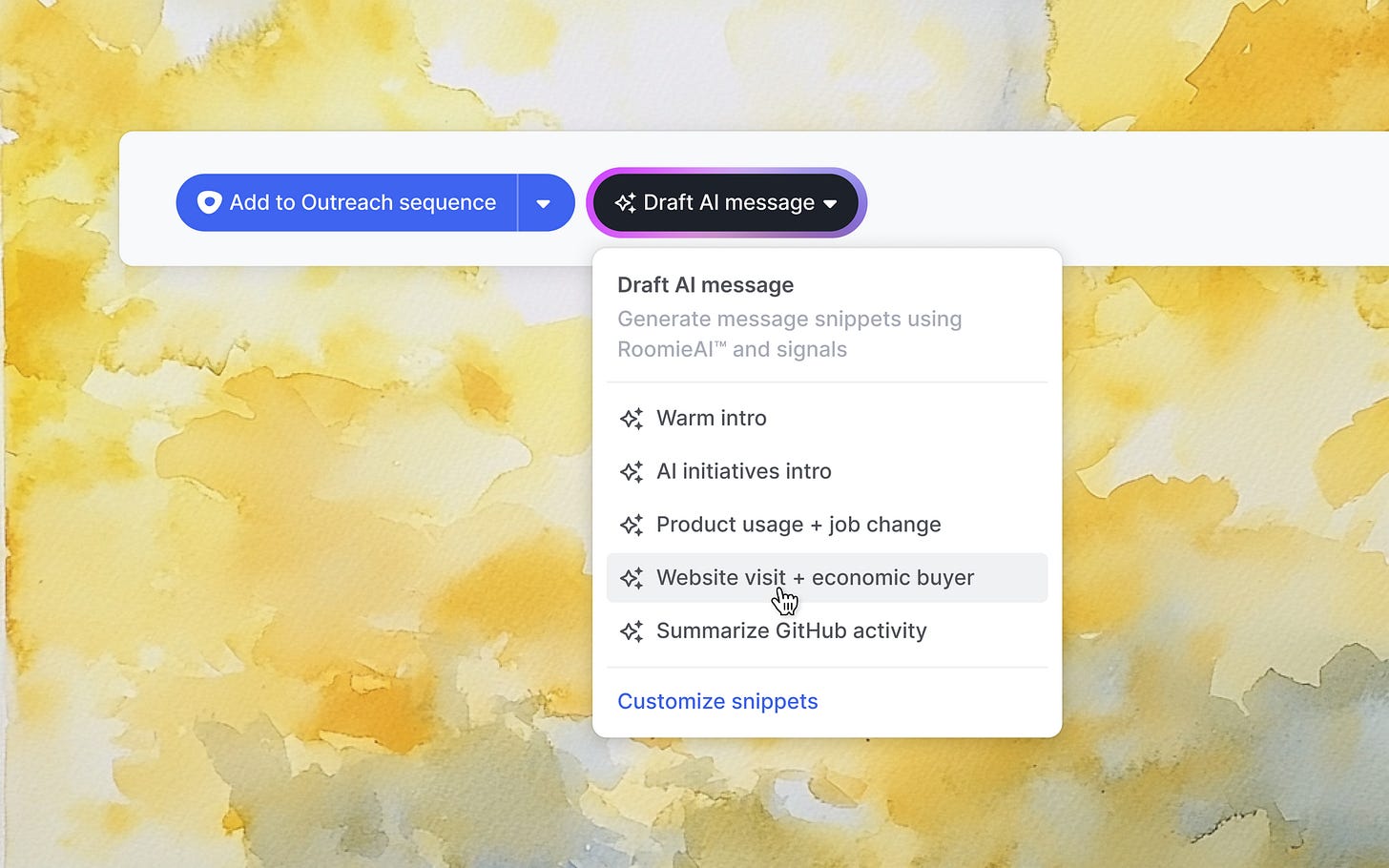

As the next step, you can write personalized messages for your selected accounts (with the help of AI) and invite them for a call, survey, or user interview.

Next, it’s time to learn directly from end users of your products to learn what can help them get the most value out of your product. Let’s explore a fast method for that 👇

2. User Surveys to Uncover Growth Insights.

When I was at Miro, my favorite part of the job was conducting user interviews. I got so passionate about it that I even set a challenge to run 100 interviews with end users in one year. It wasn’t too difficult to meet (and exceed) that goal 😅

It was an incredible investment during my first years at the company. It helped train my intuition and “gut feeling” for the years ahead. However, interviews are very time-consuming, especially if you spend 60 minutes in conversation with a stranger and lack proper preparation or context about who they are.

💬 You might ask, “Kate, how can we learn the most about users before doing interviews?”

💡 My answer: you don’t need to start with interviews. Start with a survey that helps you collect better qualitative data first. Then, run follow-up interviews only with the most relevant users who’ve already shown intent or shared something meaningful.

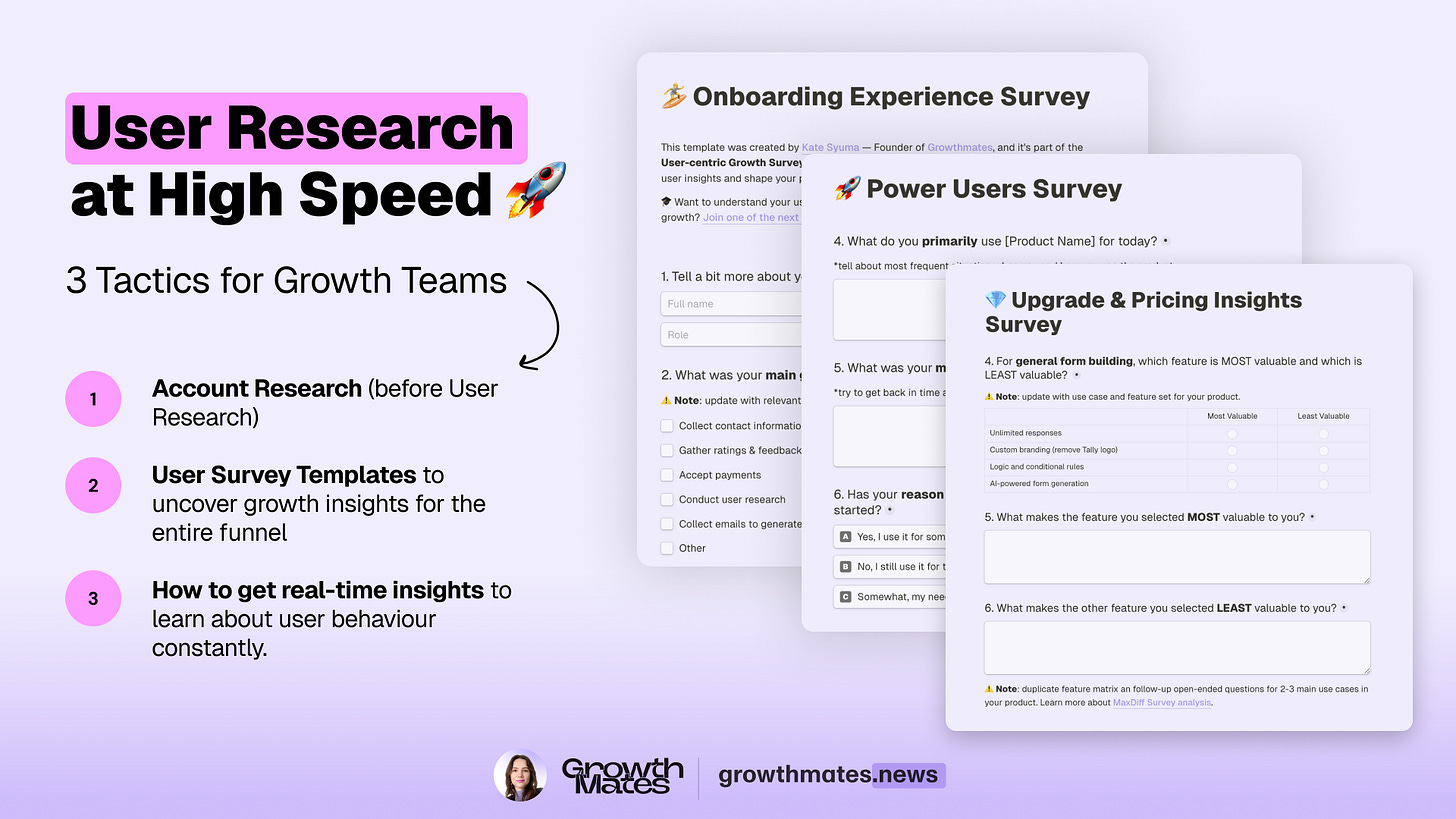

To help you get to users faster, I co-created a User-centric Surveys Pack 🔎 with Tally — a collection of 3 research-backed templates to help you uncover key user insights and shape your growth strategy:

Onboarding Experience Survey (12 questions);

Power Users Survey (17 questions);

Upgrade & Pricing Insights Survey (20 questions).

Let’s take a sneak peek here 👇

⭐️ Tips for Surveys as a research method:

Clearly state the time commitment (e.g., “Takes 5 minutes”) in both the email and survey introduction.

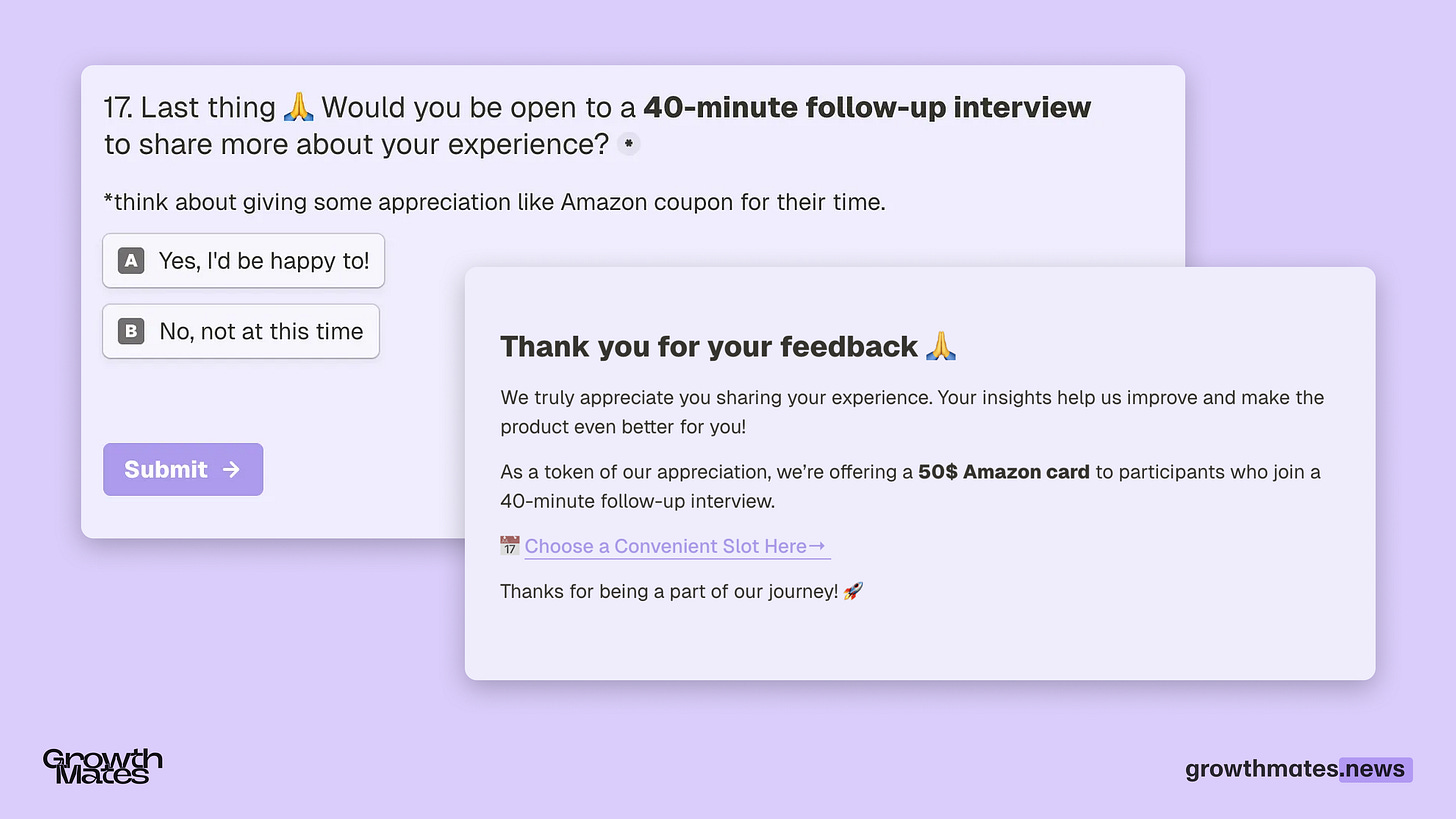

If the survey is longer than 10 minutes, offer an incentive (e.g., an Amazon gift card or 1 free month of premium access).

For longer surveys (15+ minutes), show a progress bar (e.g., “50% completed”).

Balance open-ended questions with multiple-choice to encourage completion

Limit open questions to three max unless there’s an incentive.

Send the survey from a real person, focusing the email on improving the user experience rather than just collecting data.

And a special tip 🎁 — add the invitation to a follow-up interview at the end of your survey. It will generate the the most relevant leads for your prcious interview time investment.

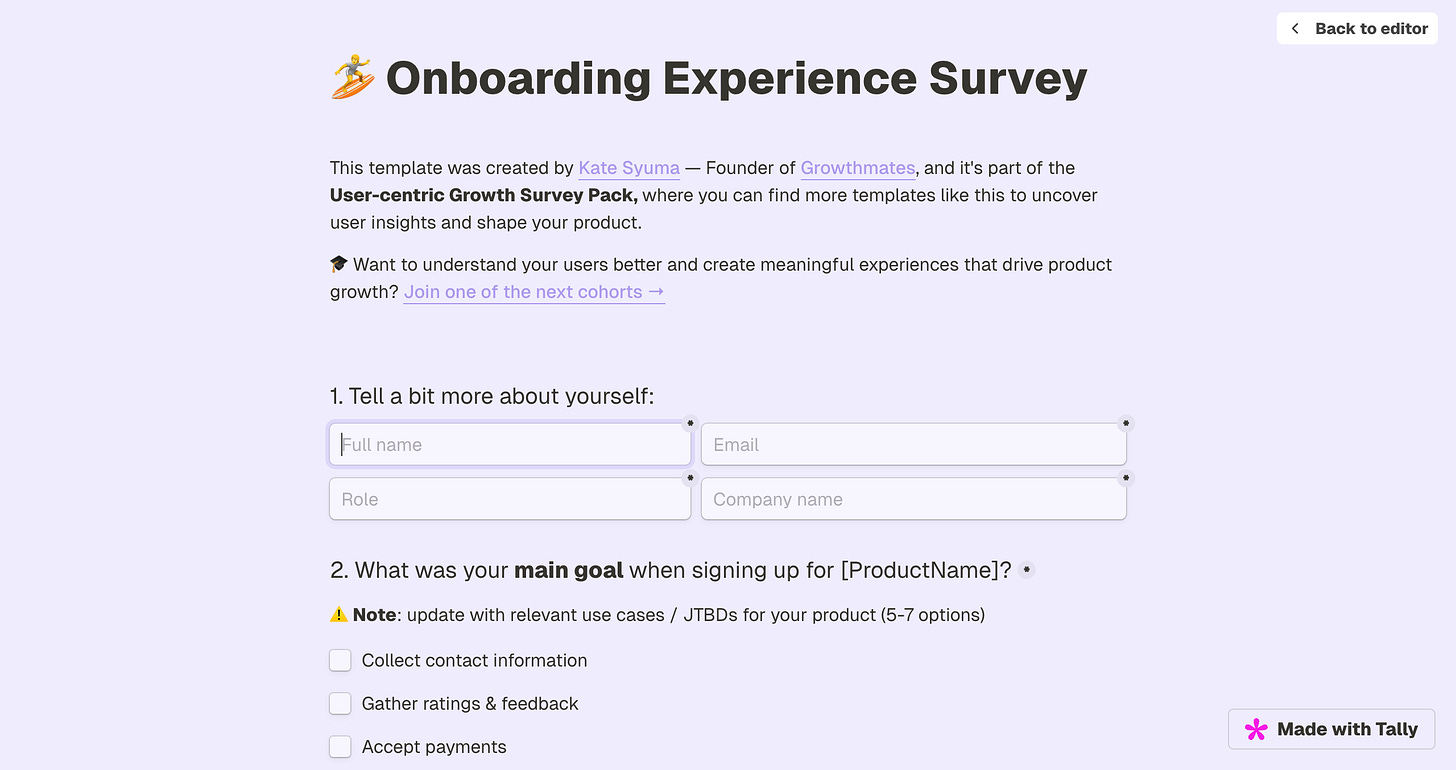

👉 Survey 1. Onboarding Experience.

Understanding how new users experience your product is key to improving activation and retention. This survey helps you uncover aha moments, pain points, and gaps in onboarding, so you can refine the journey and drive long-term engagement.

📌 Onboarding Survey Template →

📌 When to use:

Get fast insights into user behavior during their first 30 days.

Identify activation bottlenecks and areas where users struggle.

Discover what drives early value realization (=aha-moment) and where users drop off.

Clarify which part of the activation funnel has the biggest growth opportunity.

📌 Suggested Audience:

New Users who registered ~14-30 days ago.

Filter by relevant roles (ICP) to focus on the ideal customer profile.

Filter by specific use cases to ensure responses align with key product goals.

*Check if subscribed to receive surveys (for big scale).

*Send to a maximum of 1000 people at a time to avoid spam and iterate on questions.

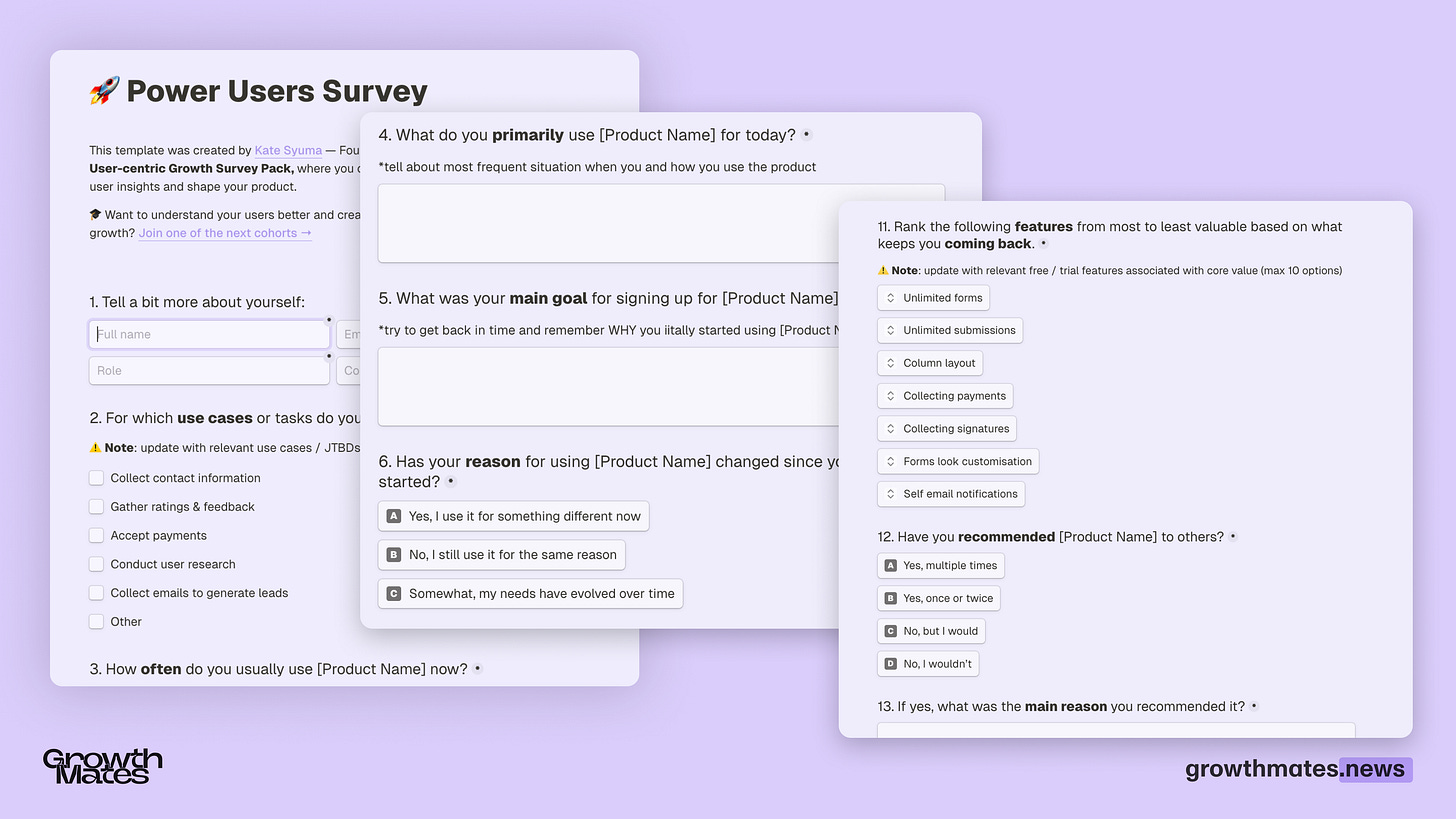

👉 Survey 2. Power Users.

This survey helps uncover why power users stick with your product, what keeps them engaged, and how they’ve built a habit around using it. These insights will help you refine the experience and enhance the most valuable features.

📌 Power Users Survey Template →

📌 When to use:

Discover how power users engage with the product and integrate it into their routine.

Uncover their initial motivations and whether they’ve evolved over time.

Identify key actions that helped them achieve their desired outcome.

Understand what made the product habit-forming and why they keep coming back.

Explore which features or experiences drive long-term stickiness.

📌 Suggested Audience:

Power Users: Highly engaged users who use the product frequently and deeply, far beyond the average user. Typically active for 6+ months with consistent, high-value interactions.

Core Users (potential to turn into power users): Regular users who engage with the product at an expected frequency, finding consistent value. Typically active for 4–6+ months and form the foundation of the user base.

Filter by relevant roles (ICP) to focus on the ideal customer profile.

Filter by specific use cases to ensure responses align with key product goals.

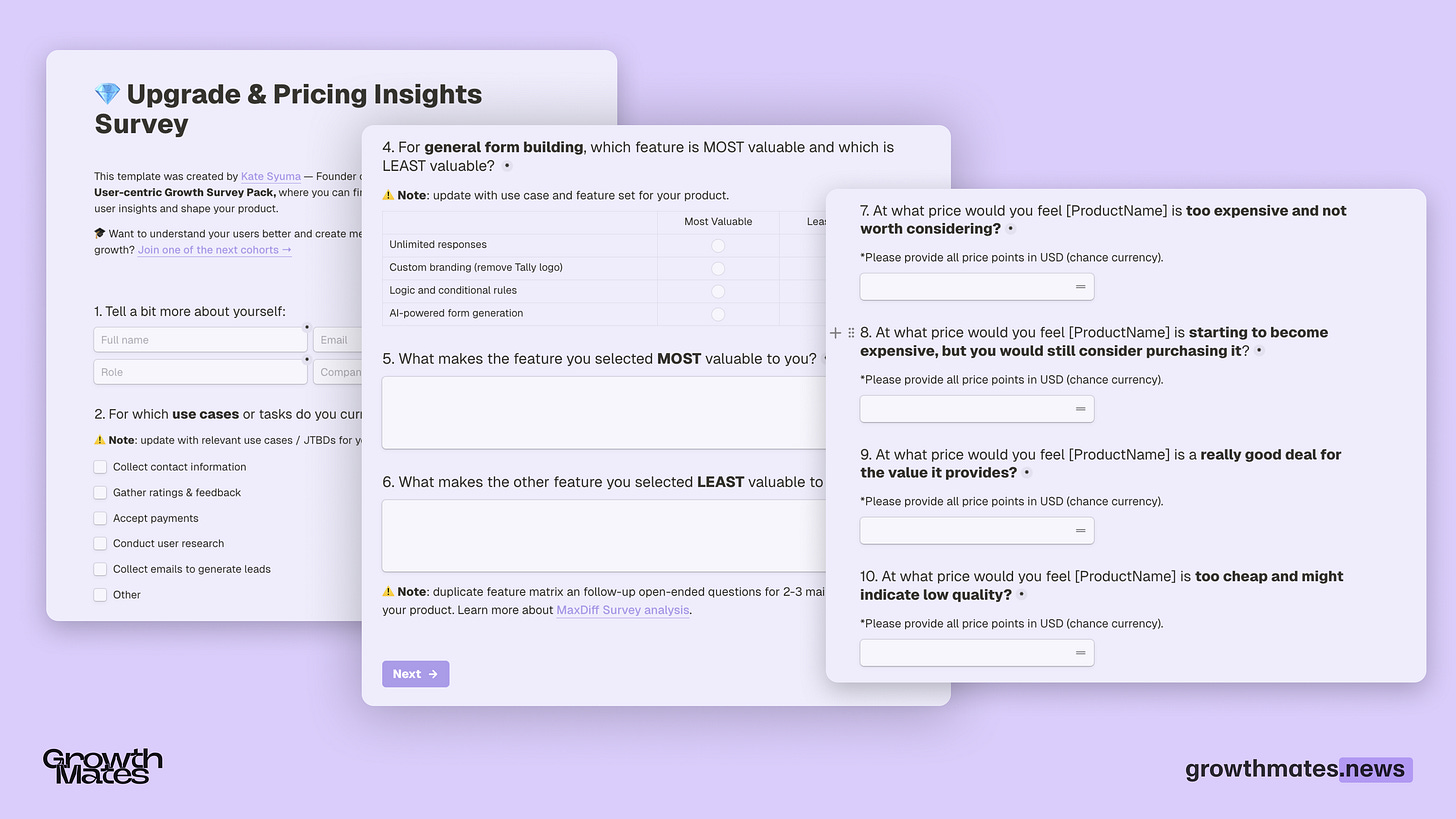

👉 Survey 3. Upgrade & Pricing Insights Survey.

This survey helps uncover how users perceive pricing, what features drive the most value, and which limitations impact upgrade decisions. It uses Van Westendorp's Price Sensitivity Meter, Gabor-Granger pricing method, and Max-Diff analysis to determine optimal pricing, feature prioritization, and upgrade triggers.

📌 Upgrade & Pricing Insights Survey Template →

📌 When to use:

Understand user willingness to pay and find the optimal price point.

Identify which feature limitations drive upgrades and where users hit paywalls.

Analyze upgrade timing—when users are most likely to convert.

Discover key barriers preventing users from upgrading to a paid plan.

Compare pricing expectations and perceptions across different user segments.

📌 Suggested Audience:

Free Plan Users – Actively use the product but haven’t upgraded; helps identify blockers and perceived value gaps.

Trial Users – Have tested premium features but haven’t converted; provides insights on upgrade hesitation and feature impact.

Paying Users – Helps assess pricing fairness, satisfaction with paid features, and potential price elasticity.

Potential Customers – Users who evaluated the product but didn’t commit; uncover pricing and feature concerns that impacted their decision.

Want to understand your users better and create meaningful experiences that drive product growth? These surveys are just a glimpse of what we cover in the User-Centric Growth Course 🚀 that I designed as a 3-week intensive where you can bring a real challenge and evaluate your key growth journeys — Onboarding, Habit-forming, or Upgrade flows. Join one of the next cohorts →

We’ve covered how surveys can save you time and help you gather valuable insights before jumping into interviews. But while you’re waiting for responses to roll in, there’s another way to collect ongoing qualitative insights — without booking a single call.

3. How to get REAL-TIME insights.

It feels like magic when you receive user data without chasing it. I still remember the “aha” moments at Miro—waking up to hundreds of new survey responses and discovering patterns I hadn’t even considered.

But as much as I love surveys, my favorite way to learn was through direct observation—watching how users actually interacted with the product in real time.

💬 You might ask, “Kate, how can you find the time—or a safe way—to observe real user behavior without setting up usability tests?”

💡 My answer: You don’t need a scheduled session or a controlled environment. Just use tools that let you passively observe real users doing real things.

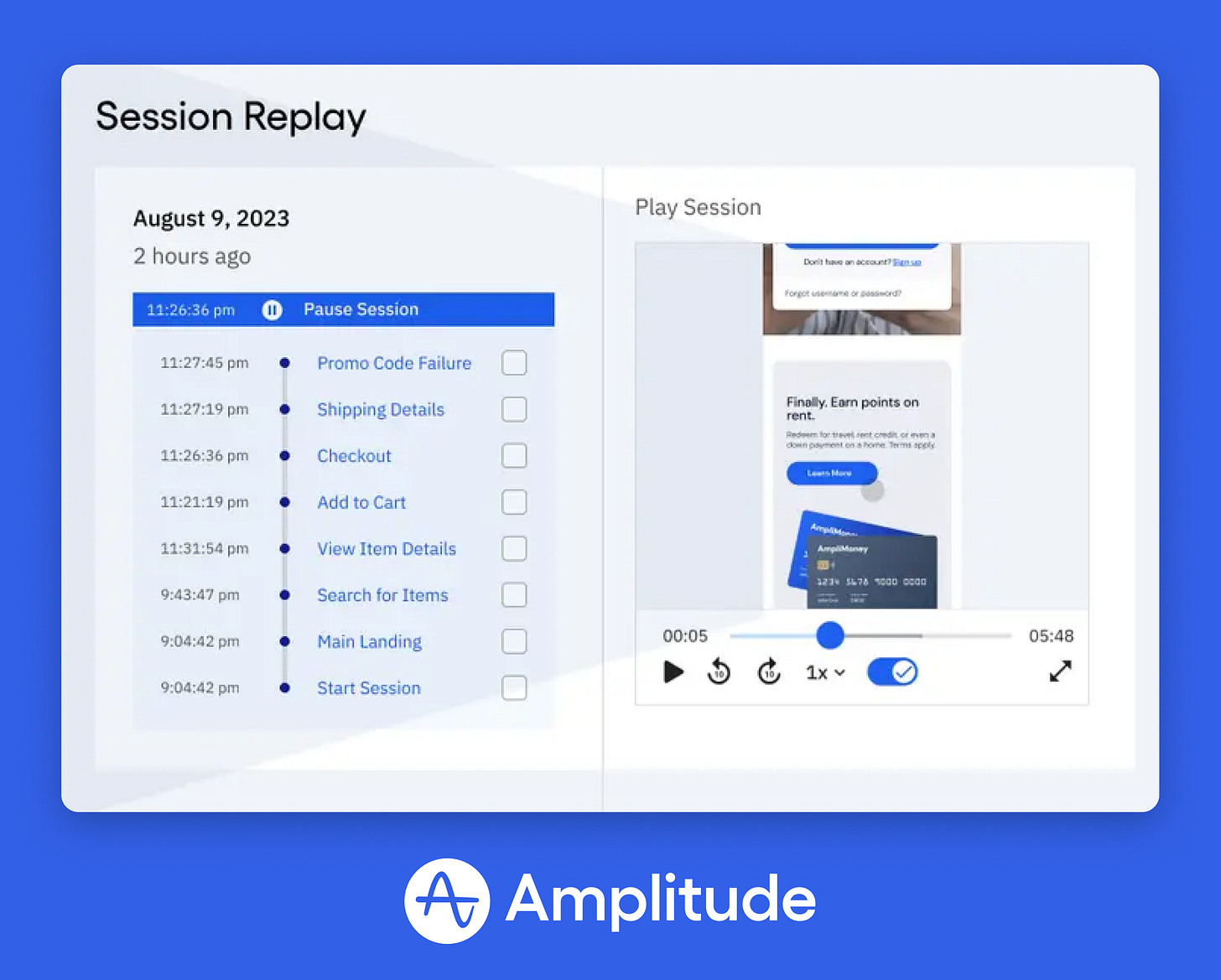

I recently discovered Amplitude Session Replay —and honestly, it feels like a superpower. You can watch actual user sessions and connect behavioral data with real-time interaction. It’s not just heatmaps or event logs — it’s full context.

You can jump directly from a user’s behavior trend (like a drop-off or unexpected conversion spike) into a session recording, seeing exactly what they clicked, where they hesitated, and what might have caused confusion. It connects the what and the why — without requiring extra tools, tracking setup, or interrupting users.

📌 How to use that:

Start from the DATA.

Identify key behavioral patterns, funnels, or anomalies — then jump directly into relevant session replays to see the why behind the numbers.Use Replays to investigate drop-offs.

Analyze sessions where users abandoned key flows (e.g. onboarding, checkout) to spot friction points or UI confusion.Validate hypotheses with real behavior.

Before running experiments, watch sessions to understand how users currently engage with a feature or flow. This is my favorite type — unmoderated usability testing. Upload your test in the evening —get results in the morning 💫Pair Quant + Qual in ONE workflow.

Combine event data with visual replays — no need to switch between tools. This gives product, design, and growth teams a shared context.

We’ve just covered how you can get closer to users, even if you don’t have a lot of time for heavy user research methods. I want to get closer to more people who see the value in learning from customers to leverage their product growth.

3 More Ways I Can Help You 👇

1. Join the User-centric Growth Course →

In this 3-week cohort-based course, you will learn proven growth strategies and behavioral science and get access to 30+ examples of Growth flows. You will practice new frameworks on your own grow challenge to uncover opportunities for Activation, Habit-forming or Upgrade flows.

2. Get a tailored Growth Program for 3 months →

As a Growth Advisor, I help companies unlock PLG with High-quality UX solutions. To help you grow, we will co-create a tailored PLG roadmap (Activation, Retention, Monetisation) and drive it together to measurable impact.

3. Get Activation & Onboarding Audit →

I will conduct a holistic audit of the onboarding flow (Video + Miro board summaries), create a roadmap of Growth initiatives and UX improvements, and you’ll get access to 30+ examples of SaaS Onboarding flows to keep working on it.

—

🎉 And one more thing for individuals like Senior Product Designers, Senior PMs, and Design leaders interested in the Growth domain — I’m re-opening 1:1 Mentorship 🚀 I had the pleasure of supporting individuals from Loom, Intercom, and Mentimeter, and now I’d like to dedicate myself to more people who need guidance. If you want to learn more → DM on Linkedin.

This is all for today, dear readers. If you found this helpful — please share your reaction and leave some comments 💜 It would give a huge support for me to continue creating this!

If you find this newsletter valuable, share it with a friend, and consider subscribing if you haven’t already. There are some discounts available, and maybe you can expense this :)

Connect with me on LinkedIn and learn more about my work on Growthmates.club.

With best regards,

Kate Syuma

lovely tips!